Saving Mr. Lincoln? No, this isn’t a post about the life and death of our 16th President. In homage and celebration of the birthday of this frugal President, this post is about saving money.

Recently, I read a short snippet in a magazine about saving $5 bills. The idea is that one saves all of the $5 bills received, whether a gift or change from a purchase. You get the picture. What a great “no brainer” idea of a savings strategy to implement painlessly! I mentioned it to Tiffany and she shared with me that in her early twenties, she and a friend did the same thing, only with $1 bills. They wanted to go to Las Vegas and challenged each other to save their dollars. In no time, they had enough for their trip and had a great time creating memories.

So often, at various points in our lives, we re-evaluate our current situation and decide that we need, should or must make changes in our lives. And, at some point in our lives, we decide that we haven’t saved enough money: enough money for retirement, enough money for an emergency fund, enough money for vacations and trips, enough money for college funds, etc. So, if you are looking for one or more strategies to get back on track and beef up your savings, this is as good a strategy as any. If saving your $5 bills is a stretch for you, choose a lower denomination, such as a dollar, or even quarters. The point is to choose one and stick with it. So, here are 5 tips to help you get started on your Saving Mr. Lincoln challenge:

-

Don’t open a savings account unless it is free of fees. Your hard-earned dollars will be eaten up by fees. Either find a facility that charges no fees or save your stash in a box, jar, hollowed out book, under your mattress (just kidding), etc. until you have enough to open an account with no fees based on a minimum balance.

-

Write down your goals. Writing them down has some kind of magical properties that makes one more accountable. Writing it down allows you to put it in front of yourself everyday as a reminder (such as a “sticky note” on your computer monitor). Writing it down makes you accountable to yourself.

-

Challenge yourself. Set a time limit to meet your challenge. For example, challenge yourself to have a minimum of five $5 bills in a month ($25).

-

Enlist a partner in crime. Ask a friend or family member to do it with you. Check in with each other periodically to see if you are on track.

-

Keep track. Whether you open a savings account at a financial institution or just create your own spreadsheet, keep track. Watching your balance grow will motivate you to keep going and may also motivate you to save in other ways, inventing new challenges.

Quotes to ponder:

“A penny saved is a penny earned.” – Ben Franklin

“I am having an out of money experience.” – Author Unknown

“In the old days a man who saved money was a miser; nowadays he’s a wonder.” – Author Unknown

“Money is power, freedom, a cushion, the root of all evil, the sum of blessings.” – Carl Sandberg

“A bank book makes good reading.” – Harry Lauder

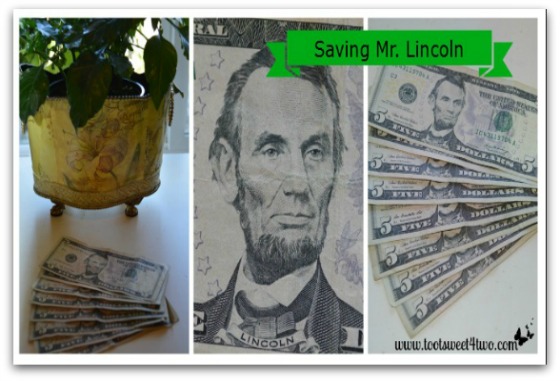

I’m starting today. I looked in my wallet and found 8 $5 bills! I’ve included a picture of them in this post. How did that happen? See, it can happen organically…I’m sure I just kept giving people $20’s and they kept giving me change.

Since it is the middle of the month, I going to challenge myself to save at least two more $5 bills by the end of the month stashed in my secret hiding place (well, it’s not really secret because I’ve told both Charlie and Tiffany just in case I “kick the bucket” before I’ve saved enough to put it in a free bank account! Wouldn’t want them to accidentally throw it away in a cleaning frenzy!). Also, I’m sure that now that I’m tracking it, my $5 bills will be less than 10 a month. But, hey, that’s okay. This is about saving and spending less and if I’m breaking less $20 bills, then I’m spending less, right?

Will you join me? I’ll report back monthly to keep me in line. I’d enjoy hearing your stories via comments and watching your savings grow, too! Let’s Save Mr. Lincoln together.

Happy Birthday, Mr. Lincoln!

Tootles,

Related Posts:

(other Saving Mr. Lincoln posts)

- Saving Mr. Lincoln

- Saving Mr. Lincoln – March 2013 Update

- Saving Mr. Lincoln – April 2013 Update

- Saving Mr. Lincoln – May 2013 Update

- Saving Mr. Lincoln – June 2013 Update

- Saving Mr. Lincoln – July 2013 Update

- Saving Mr. Lincoln – August 2013 Update

- Saving Mr. Lincoln – September 2013 Update

- Saving Mr. Lincoln – October 2013 Update

- Saving Mr. Lincoln – November 2013 Update

- Saving Mr. Lincoln – December 2013 Update

- Saving Mr. Lincoln – January 2014 Update

Very good idea. Mike and I were just discussing how/when we can start saving more money. This is a small but effective way to do it, especially if you have a goal of how to spend it.

You know, it really adds up fast! Charlie gave me another $5 today from his wallet because he now wants to participate! I think we’re on to something!

Oh my goodness I LOVE this idea!! Rob & I already have tons of “piggy banks” that we put our change in. Ima make one just for Mr. Lincoln now!

Good girl! Before you know it, you’ll have enough for another trip to Disneyland! Love you!